While the United States has had a history of military unilateralism that long predates the election of Donald Trump, global markets tended to rely on the US as not only a strong but a predictable and stable economic partner. While the US under Trump is domestically strong as indicated by a generally bullish stock market, confidently climbing interest rates, a strong Dollar and positive growth and employment rates, when it comes to America’s economic dealings with long time geo-economic partners, the US has become increasingly flippant, and unilateral. The result is that today, the US is a less reliable global economic partner than at any time since prior to the early 20th century.

Predictable chaos

During the first year of the Trump Presidency, many wondered whether Trump’s talk of tariffs, direct sanctions and expanded second-party sanctions were empty rhetoric or genuine threats. Because of this, many nations literally hedged their bets and continued their economic relations with the US with the underlying assumption that the traditional status quo of relatively free trade, easy access to US capital and continued access to US financial institutions would proceed as it had over previous decades.

However, the last 10 months have clearly demonstrated that when it comes to the use of tariffs, sanctions and de-facto economic warfare against both long time partners (the EU, Turkey, Canada, Mexico, South Korea, Pakistan, Japan) rivals whose economic partnership is vital to the US economy (China), rivals who could potentially cooperate with the US in the Middle East (Russia) and newly acquired partners (India), the US will act mercilessly in attempting to force such countries to submit their own economic sovereignty to the will and whims of the United States. The result has been that multiple nations are now faced with the reality that in hedging their bets early in the Trump era, the bluff has been called and Trump now holds an undeniable upper hand against virtually every aforementioned nation except China.

While China’s status as an economic behemoth that every nation in the world is deeply reliant on for their own domestic property has helped to shield Beijing from the worst effects of the wider economic war of the Trump era, for every other nation that is now a victim for tariffs, sanctions and other non-tariff barriers to trade that have been erected by the US – it is time to face the new reality.

A new era in global economics – whether the world likes it or not

When one realises that Japan, China, both Korean states, Turkey, India, Pakistan, Iran, Syria, all 28 states of the European Union including Britain, Russia, Canada, Colombia, Venezuela and Mexico have all either met the whip hand of Trump tariffs or sanctions that show no signs of abatement, it is not hyperbolic to say that in economic terms, the new reality is one of ‘America versus the world’.

This is not to say that military or hybrid war consequences will result from America’s economic war in respect of all targeted nations. Many of Trumps’ targets remain key US partners in certain areas to do with security. But in terms of reliance on the US Dollar as a practical means of exchange, relying on US financial institutions and relying on the US to allow for something approximating free trade - the wider world must accept that what once was a safe assumption is now foolish wishful thinking.

The fact of the matter is that while the US is open for business, it is only open for business on its terms. Compounding this is the reality that these terms are becoming increasingly hostile for every major and medium sized trading partner of the US.

One Belt—One Road beckons

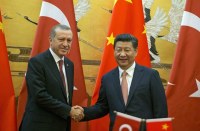

While China’s One Belt—One Road initiative was popular among many developing and diversifying economies from the moment it was introduced in 2013, the global financial consensus in 2013 was still overwhelmingly driven by Washington. Today though, with China increasing lines of credit to trading partners, with China opening up its own markets to trade and capital inflow at unprecedented levels, with the arrival of the Petroyuan and with more and more nations gradually moving away from a strong but ‘out of reach’ US Dollar, China’s status as a financial hub with a stable currency is becoming not only unavoidable but deeply attractive.

Donald Trump’s economic ‘fortress America’ is giving way to a new status quo in global finance and trade. In this new era, Shanghai is looking increasingly friendly vis-à-vis Wall Street while the diplomatic efforts to pursue trade under the guise of peace through prosperity and openness is far more realistic a methodology for the wider world than an “American first” Washington which literally discards the concerns of many long-time partners.

Therefore, while One Belt—One Road was once a highly attractive road to new opportunities, today the belts and roads leading to China are the only viable alternative to an American model in which many nations are no longer welcome.

Conclusion

Rather than continue to hedge unrealistic bets, the wider world which includes all of the countries named in this peace and more, ought to pivot their financial future towards a China orientated direction. The US and China are unique economic superpowers but while one is closing its doors and closing its mind, the other is opening both. It’s therefore a question of America First vs. Win-Win. Unless you are an American business, circumstance has already made the choice. The only remaining matter is acting upon it with immediate conviction.